Transforming Marine Insurance Through Multi-Agent Agentic AI Ecosystems

The marine insurance industry stands at a critical inflection point. While competitors like Zurich and Concirrus deploy AI agents to automate submission extraction and risk modeling, the gap between early adopters and late movers widens daily. This article presents a comprehensive framework for marine insurers to transform from passive GenAI experimentation to active agentic automation; delivering measurable ROI in 4-12 months.

Posted by

AI Transformation Desk

Posted at

AI Transformation

Posted on

Feb 8, 2026

Executive Summary

The marine insurance industry stands at a critical inflection point. While competitors like Zurich and Concirrus deploy AI agents to automate submission extraction and risk modeling, the gap between early adopters and late movers widens daily. This article presents a comprehensive framework for marine insurers to transform from passive GenAI experimentation to active agentic automation; delivering measurable ROI in 4-12 months.

Traditional models, reliant on manual processes and passive analytics, are giving way to active, autonomous AI systems. At Agentics, we've pioneered agentic AI solutions tailored to the unique challenges of marine insurers.

This article explores the transformative potential of AI, drawing on real-world applications to show how it can drive efficiency, mitigate risks, and unlock new revenue streams. For C-suite executives, underwriting leaders, and IT heads: this is your playbook for building competitive advantage through AI while managing risk, ensuring compliance, and protecting data sovereignty.

1. The AI Revolution in Marine Insurance: Market Statistics and Projections

1.1 Current Market Landscape

The global marine insurance market, valued at approximately $35 billion in 2024, is experiencing a technological transformation driven by AI adoption. Industry analysts project that AI-powered solutions will capture 35-40% of operational workflows by 2027, representing a compound annual growth rate (CAGR) of 28% in AI technology investment specifically within marine insurance.

Key Market Drivers

• Operational Pressure: Manual submission processing takes 3-7 days on average; AI agents reduce this to hours, enabling carriers to compete on speed of quote delivery. Underwriters spend 60-70% of their time on administrative tasks rather than risk assessment.

• Regulatory Complexity: Sanctions screening (OFAC, EU, UN) and AML compliance requirements have increased 45% since 2020, creating bottlenecks that AI agents can eliminate.

• Data Explosion: 60-80% of operational intelligence exists in unstructured formats (emails, PDFs, vessel surveys, claims documentation). Traditional systems analyze only structured data, missing 60% of actionable insights.

• Competitive Displacement: Insurtech startups and forward-thinking incumbents are capturing market share by offering 24–48-hour quote turnaround versus the industry standard of 5-10 days.

Investment and ROI Projections

Marine insurers investing in Multi-Agent Agentic AI Systems have reported:

• 20-40% reduction in operational costs within the first year

• 35-50% faster claims processing, improving customer satisfaction scores by 25-30%

• 60-85% reduction in compliance processing time, eliminating regulatory penalties

• ROI payback period: 4-12 months for properly scoped pilot implementations

2. From Passive Chat to Active Agents: Understanding the Paradigm Shift

Most marine insurers have experimented with GenAI chatbots; conversational tools that answer questions and summarize documents. However, the competitive frontier has moved beyond passive assistance to Agentic action i.e. Autonomous systems that perceive context, make decisions, use tools, and execute tasks without constant human intervention.

2.1 The Anatomy of an AI Agent

An AI agent operates through four core capabilities:

• Trigger: Monitors for specific events (e.g., new email submission, sanctions list update, claim filing)

• Context Understanding: Large Language Models (LLMs) comprehend unstructured data—emails, vessel specifications, policy documents

• Tool Integration: Accesses databases (sanctions lists, underwriting guidelines), APIs (weather data, vessel tracking), and enterprise systems (policy admin, claims management)

• Autonomous Action: Executes decisions—extracts data, flags compliance risks, drafts correspondence, queues approvals

Example: A submission arrives via email. A GenAI chatbot can summarize it. An AI agent can read the email, extract vessel details, check the owner against sanctions databases, cross-reference underwriting appetite, draft a decline letter if non-compliant, and queue it for human approval—all within seconds.

3. The Agentics Solution Approach: Solving Marine Insurance Business Problems

Marine insurance operations are plagued by high-friction processes: unstructured submissions via emails and PDFs, stringent global sanctions and AML requirements, and the need for specialized services like recovery and loss prevention. A

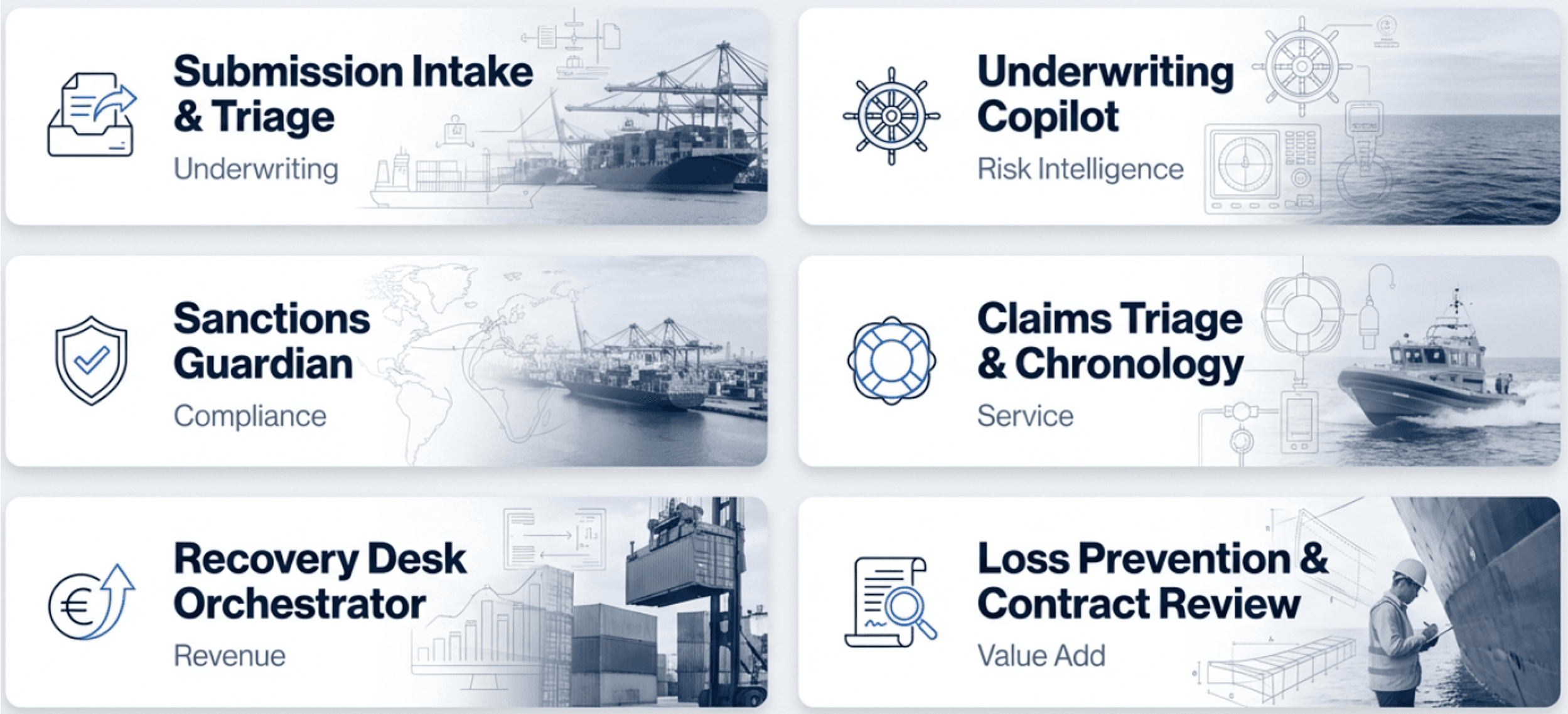

Agentics addresses these with a "Top 6" Agent Ecosystem, evolving from passive GenAI chatbots to active, goal-oriented agents that use tools autonomously. Unlike chatbots that merely summarize, our agents act i.e. reading emails, checking databases, drafting documents, and queuing actions for human approval.

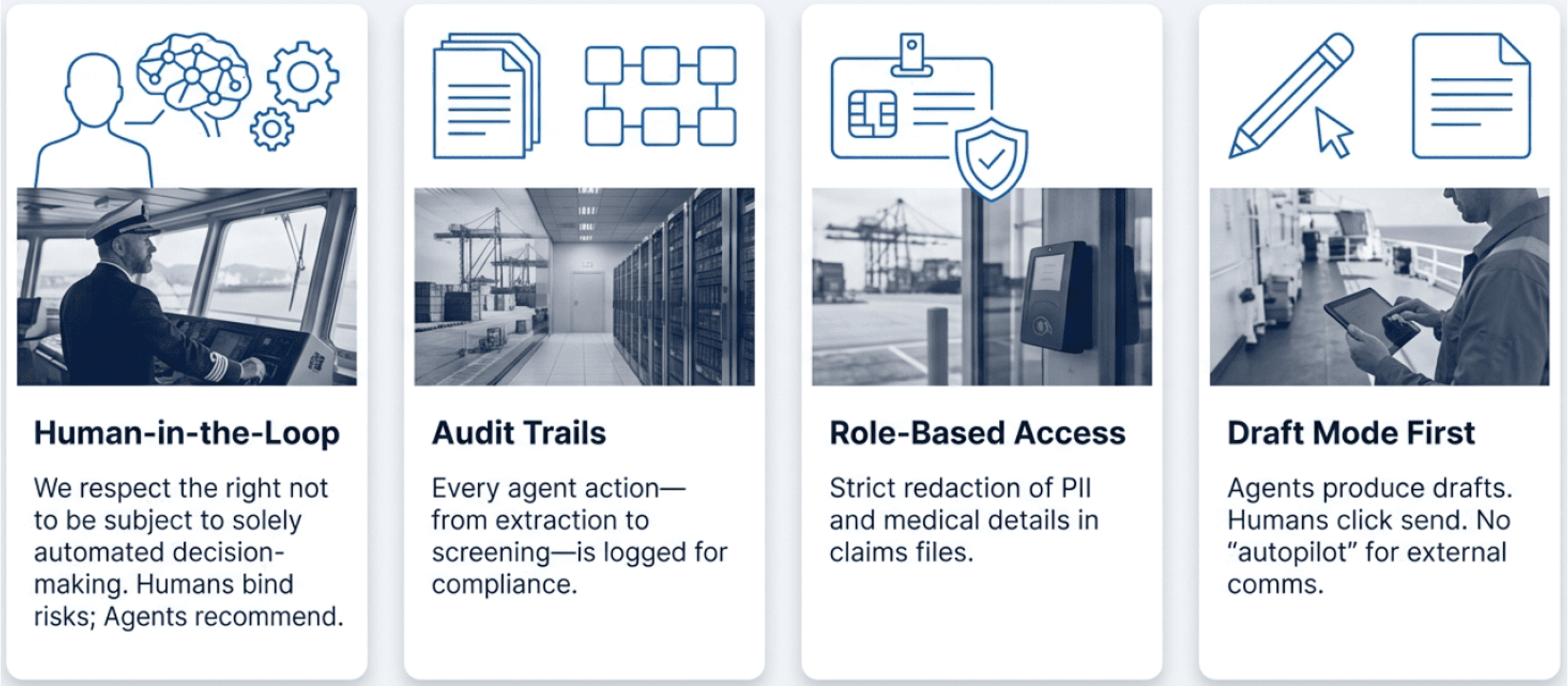

This multi-agent system (MAS) combines structured and unstructured data analysis, ensuring human-in-the-loop oversight for trust and compliance. It respects privacy notices by avoiding fully automated decisions, maintains audit trails, and redacts sensitive information.

Our phased rollout starts with "no-regret" pilots, like knowledge retrieval and email classification, deployable in weeks, delivering 20-40% efficiency gains and de-risked growth. By focusing on triage, compliance, and revenue maximization, we amplify differentiators like in-house recovery desks, turning friction into competitive advantage.

At Agentics, we don't deploy AI for technology's sake. We engineer Multi-Agent Intelligence Systems (MAS) that address specific business bottlenecks faced by marine insurers.

Our approach combines:

• Structured + Unstructured Data Integration: While competitors analyze only 40% of available data (structured databases), we unlock the remaining 60% trapped in emails, PDFs, and documents—delivering complete operational intelligence.

• Validation-First Framework: We pilot solutions with clearly defined success metrics before full-scale deployment, de-risking your investment.

• Human-in-the-Loop Intelligence: Agents handle routine decisions autonomously while escalating edge cases to underwriters, claims adjusters, or compliance officers—maintaining oversight without sacrificing speed.

3.1 Why Marine Insurance is Uniquely Suited for Agentic AI

Marine insurance operations are characterized by:

• High-Friction Submissions: Brokers submit incomplete documentation across multiple formats. Agents standardize intake and triage instantly.

• Complex Compliance Requirements: Sanctions/AML checks, trade route validation, and regulatory reporting create manual workload. Agents automate screening with audit trails.

• Specialized Value-Adds: Functions like Recovery Desks (subrogation management) rely on document-intensive workflows that agents can orchestrate at scale.

4. The Priority Ecosystem: Top 6 High-Impact Agentic AI Agents for Marine Insurance

Based on extensive industry analysis and pilot implementations, we recommend a phased deployment of six agents that deliver immediate ROI while building toward comprehensive automation.

Agent 01: Submission Intake & Triage

The Problem: Brokers submit risks via email with inconsistent formatting—some include attachments (vessel surveys, cargo manifests), others embed details in email bodies. Underwriters spend 2-3 hours per submission manually extracting data, cross-referencing guidelines, and routing to the appropriate specialist.

The Solution: The Submission Intake Agent monitors email inboxes, extracts key data points (vessel type, cargo value, route, coverage requested), classifies submissions by complexity and line of business, and auto-routes to the correct underwriter with a pre-filled summary.

Business Benefits

• Time Savings: Reduce intake processing from 2-3 hours to 5 minutes per submission

• Accuracy: Eliminate data entry errors and ensure consistent field population

• Speed to Quote: Begin underwriting assessment within minutes of submission receipt

• Scalability: Handle volume spikes (e.g., hurricane season) without hiring temporary staff

Agent 02: The Underwriting Copilot

The Problem: Underwriters toggle between multiple systems—policy admin platforms, external databases (vessel registries, loss history), internal guidelines—to assess risk. This context-switching burns 40-50% of productive time and increases the likelihood of overlooking critical risk factors.

The Solution: The Underwriting Copilot functions as a real-time assistant embedded in the underwriter's workflow. It retrieves vessel loss history, analyzes route risk (piracy zones, weather patterns), cross-references underwriting appetite, suggests pricing parameters, and flags exceptions requiring senior approval.

Business Benefits

• Decision Quality: Surface insights from 100+ data sources that humans cannot synthesize at speed

• Consistency: Apply underwriting guidelines uniformly across teams and geographies

• Productivity: Increase quote capacity per underwriter by 30-40%

• Training Acceleration: Junior underwriters reach proficiency 50% faster with AI guidance

Agent 03: The Sanctions & Trade Compliance Guardian

The Problem: Regulatory violations carry existential risk e.g. OFAC fines can reach millions of dollars, and reputational damage compounds losses. Yet manual sanctions screening (checking vessel owners, charterers, ports of call against 10+ global lists) is error-prone and slow, creating bottlenecks in quote issuance.

The Solution: The Compliance Guardian automatically screens every submission against OFAC, EU, UN, and other sanctions databases. It monitors for list updates in real-time, flags matches with confidence scores, generates audit-ready compliance reports, and auto-declines submissions with high-risk entities while queuing borderline cases for legal review.

Business Benefits

• Risk Mitigation: Eliminate false negatives that expose the firm to regulatory penalties

• Speed: Reduce compliance screening from 4-6 hours to under 1 minute

• Audit Trail: Maintain complete records for regulatory examinations

• Competitive Advantage: Provide instant compliance clearance, winning business against slower competitors

Agent 04: Claims Triage & File Summarization

The Problem: Marine claims files can span hundreds of pages across incident reports, cargo surveys, vessel logs, correspondence between multiple parties. Adjusters spend days reading through documentation to establish timelines, identify liability, and spot inconsistencies. This delays settlement and erodes customer satisfaction.

The Solution: The Claims Triage Agent ingests unstructured documentation (PDFs, emails, photos), extracts key facts, builds chronologies of events, flags discrepancies between documents, and generates executive summaries for adjusters, transforming weeks of analysis into hours.

Business Benefits

• Faster Settlements: Reduce time-to-decision by 35-50%

• Cost Control: Identify red flags (fraud indicators, policy exclusions) earlier in the lifecycle

• Customer Experience: Improve Net Promoter Scores through faster payouts

• Peer Validation: Zurich and Allianz have deployed similar agents for claims trend analysis and food spoilage claims

TECHNICAL NOTE: This agent demonstrates Agentics' core differentiator—our Multi-Agent Systems extract intelligence from both structured claims databases AND unstructured documents, providing 100% visibility versus competitors' 40%.

Agent 05: The Recovery Desk Orchestrator

The Problem: Subrogation i.e. recovering costs from liable third parties, is a high-value but labor-intensive function. Recovery teams manually review claim files to identify subrogation potential, draft demand letters, track correspondence with counterparties, and coordinate legal action. Volume constraints limit recovery rates.

The Solution: The Recovery Desk Orchestrator analyzes closed claims to identify subrogation opportunities, scores cases by likelihood of recovery, auto-generates demand letters, tracks response deadlines, and escalates to legal when thresholds are met. It manages the entire workflow from identification through settlement.

Business Benefits

• Revenue Recovery: Increase subrogation success rates by 25-35% through systematic pursuit

• Scalability: Expand recovery operations without proportional headcount increases

• Efficiency: Free recovery specialists to focus on complex negotiations versus administrative tasks

• Loss Ratio Improvement: Each percentage point improvement in recovery translates directly to EBIT growth

Agent 06: Contract Review & Loss Prevention

The Problem: Charter party agreements, bills of lading, and cargo contracts often contain clauses that shift liability or create coverage gaps. Legal teams lack bandwidth to review every contract, leading to avoidable claims when disputes arise.

The Solution: The Contract Review Agent analyzes shipping contracts for risk-transferring language, flags unfavorable terms (e.g., excessively broad indemnities), compares clauses against best practices, and recommends protective endorsements. It serves as a first-pass review before legal escalation.

Business Benefits

• Loss Prevention: Identify coverage gaps before claims materialize

• Legal Cost Reduction: Triage routine contracts away from expensive outside counsel

• Client Advisory: Provide insured with contract feedback as a value-added service, strengthening retention

• Knowledge Capture: Build institutional memory of problematic clauses and counterparties

5. Agentic AI Use Case Matrix: Functional Applications Across Marine Insurance Operations

Beyond the six priority agents, AI capabilities can transform every function within a marine insurance organization. The following matrix maps use cases to departments, providing a strategic framework for enterprise-wide AI adoption.

Function/Department | AI Use Cases | Business Impact |

Underwriting | • Automated risk assessment & pricing • Vessel & cargo valuation verification • Route risk analysis (weather, piracy) • Appetite matching & referral routing • Portfolio concentration monitoring | 30-40% increase in quote capacity per underwriter; 25% improvement in risk selection accuracy; faster speed-to-quote wins competitive business |

Compliance & Legal | • Real-time sanctions screening (OFAC, EU, UN) • AML/KYC automation • Regulatory reporting automation • Contract clause analysis • Policy wording review | 60-85% reduction in compliance processing time; elimination of regulatory penalties; complete audit trails; legal cost reduction of 40-50% |

Claims Management | • First notice of loss (FNOL) processing • Document summarization & timeline creation • Fraud detection & red flag identification • Reserve estimation & validation • Settlement recommendation engines | 35-50% faster claims resolution; improved customer satisfaction (25-30% NPS increase); fraud loss reduction of 15-20%; better reserve accuracy |

Distribution & Broker Management | • Broker performance analytics • Quote comparison & benchmarking • Renewal forecasting & retention prediction • Commission automation • Portal chatbots for broker queries | Improved broker satisfaction; 10-15% increase in renewal rates through predictive outreach; streamlined commission processing reduces disputes |

Finance & Actuarial | • Premium audit automation • Reserve adequacy modeling • Loss trend analysis & forecasting • Reinsurance treaty optimization • Financial close acceleration | Faster financial reporting (40% reduction in close time); improved forecast accuracy; optimized reinsurance spend through data-driven treaty design |

Risk Management | • Exposure aggregation & concentration monitoring • Catastrophe modeling (hurricanes, earthquakes) • Portfolio stress testing • Emerging risk identification • Loss control recommendations | Real-time visibility into aggregate exposures; proactive risk mitigation reduces catastrophic loss potential; enhanced capital efficiency |

Customer Service | • 24/7 policyholder chatbots • Certificate of insurance generation • Coverage inquiry automation • Endorsement processing • Multi-language support | 50% reduction in service center call volume; instant response to routine queries; improved first-contact resolution rates; extended service hours without staffing costs |

Operations & IT | • Data extraction from legacy systems • Process mining & optimization • Robotic process automation (RPA) integration • Data quality monitoring & cleansing • IT ticket triage & resolution | 20-40% reduction in operational costs; unlocks data from siloed legacy platforms; improves system uptime through predictive maintenance |

HR & Training | • Onboarding acceleration • Knowledge management & search • Skills gap analysis • Personalized learning paths • Performance analytics | 50% reduction in time-to-productivity for new hires; institutional knowledge preservation as experienced underwriters retire; data-driven talent development |

Loss Prevention & Survey | • Vessel inspection report analysis • Predictive maintenance recommendations • Safety violation tracking • Risk engineering insights • Client advisory content generation | Reduces frequency and severity of losses; positions insurer as risk partner versus transactional vendor; improves client retention through value-added services |

Implementation Insight: Successful AI transformation requires a balanced approach.

Start with high-impact, low-complexity use cases (e.g., email classification, document extraction) to build organizational confidence.

Then expand to decision-support applications (underwriting copilots, claims triage) before deploying fully autonomous agents for routine tasks.

Agentics' Validation-First Framework ensures each phase delivers measurable ROI before proceeding.

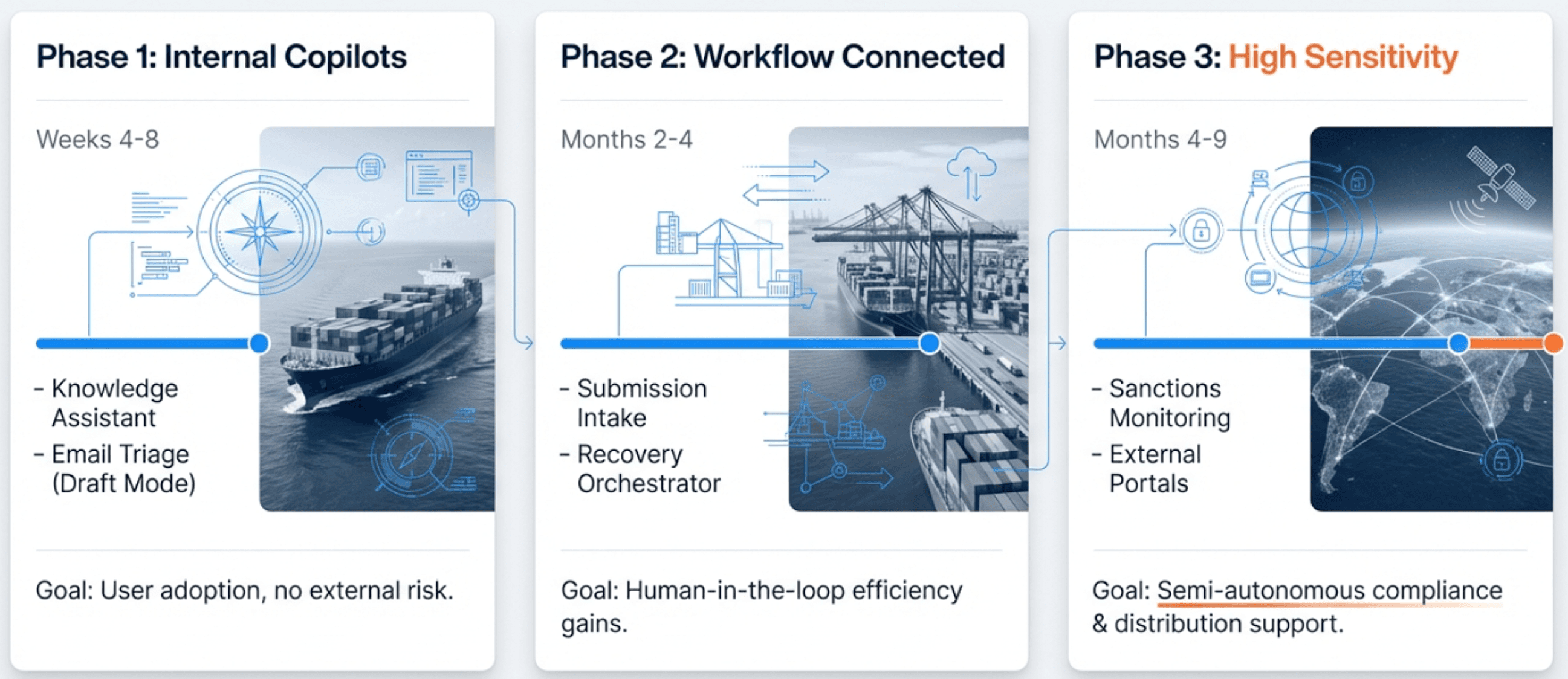

6. Phased Adoption Strategy: The 'Safe-Scale' Horizon

AI transformation is not a binary switch but a journey. Based on our experience deploying Multi-Agent Systems across insurance clients, we recommend a three-phase approach that balances speed, risk mitigation, and organizational readiness.

PHASE 1: Foundation (Months 1-3) – 'No Regret' Pilots

Success Metrics

• 30% reduction in time spent searching for information

• 95% email routing accuracy

• 80% user adoption within pilot teams

PHASE 2: Acceleration (Months 4-9) – High-Impact Automation

Success Metrics

• 20-30% increase in underwriting capacity

• 60% reduction in compliance processing time

• 25% faster claims cycle time on pilot segment

PHASE 3: Scale & Optimize (Months 10-18) – Enterprise Integration

Success Metrics

• 30-40% reduction in total operating expenses

• 2-3 point improvement in combined ratio

• Industry-leading Net Promoter Score (NPS) due to speed and service quality

7. Designing for Trust, Security & Data Sovereignty

Marine insurers handle sensitive data e.g. vessel ownership structures, cargo valuations, claim details, and trade routes. AI adoption cannot compromise data security or regulatory compliance.

Agentics builds trust into every deployment through:

Data Privacy by Design

• PII/PHI Redaction: Automatic removal of Personally Identifiable Information and Protected Health Information before documents enter AI processing pipelines

• Role-Based Access Control: Agents access only data necessary for their specific function—claims agents cannot see underwriting data

• Encryption at Rest and in Transit: All data encrypted using AES-256 standards with key rotation

Regional Data Residency

• EU Operations: Data processed and stored within EU data centers for GDPR compliance

• Middle East/Asia: Local hosting options available in UAE, Singapore, India

• US Operations: SOC 2 Type II certified infrastructure

Model Governance & Explainability

• Audit Trails: Every agent decision logged with reasoning, data sources, and confidence scores

• Human Override: Underwriters and claims adjusters can override agent recommendations and feed corrections back into the learning loop

• Bias Monitoring: Regular audits ensure agents do not exhibit demographic, geographic, or vessel-type biases

Vendor Risk Management

Unlike consultancies that disappear post-implementation, Agentics provides:

• Ongoing Optimization: Monthly performance reviews with built-in improvement ratchets (e.g., AI models must improve 3% monthly)

• 24/7 Monitoring: Dedicated support teams across time zones ensure continuous uptime

• Knowledge Transfer: Train your internal teams to manage and extend the agent ecosystem

Why Partner with Agentics?

The marine insurance AI market is crowded with vendors offering chatbots, RPA tools, and analytics dashboards. Agentics is different. We are the Anti-Consultancy; a coalition of strategists, growth hackers, and AI architects who don't just advise; we build, deploy, and optimize.

Our Competitive Differentiators

1. Complete Intelligence: Structured + Unstructured Data

While competitors analyze only structured databases (40% of operational intelligence), our Multi-Agent Intelligence Systems unlock the 60% trapped in emails, PDFs, vessel surveys, and claim documentation. This delivers 100% visibility—the foundation for superior decision-making.

2. Validation-First, De-Risked Deployment

Our proprietary framework pilots solutions with clear success criteria before full-scale rollout. You see ROI in 4-12 months—not the 18-36 month timelines typical of big consultancies.

3. End-to-End Ownership

We don't hand off PowerPoint decks and disappear. Our team manages:

Strategy & roadmapping >> Solution design & engineering >> Integration with core systems >> Change management & training >> Continuous optimization

4. Global Execution, Boutique Attention

With delivery centers in Amsterdam, Zurich, Istanbul, Bengaluru, Mumbai, Warsaw, Lisbon, Singapore, Johannesburg, Toronto, and Buenos Aires, we combine local market expertise with cost-efficient execution. You get Silicon Valley-grade AI without bloated big-consultancy fees.

5. Insurance Domain Expertise

Our team includes former underwriters, claims professionals, and compliance specialists who understand your challenges. We speak insurance fluently, not generic tech jargon.

Your Next Steps: From Insight to Action

The marine insurance market is bifurcating—firms that deploy agentic AI now will capture market share, while late movers face margin compression and talent disadvantages.

The question is not whether to adopt AI agents, but how quickly and with whom.

What We Offer You

Complimentary Strategic Consultation

Schedule a 90-minute session with our team to:

• Assess your current AI maturity across underwriting, claims, compliance, and operations

• Identify your highest-ROI use cases based on pain points and data availability

• Develop a customized roadmap with phased milestones and success metrics

Pilot Program Design

We'll propose a 'no regret' Phase 1 pilot—typically focused on submission intake or compliance screening—with:

• Fixed scope and timeline (8-12 weeks)

• Transparent pricing (no hidden fees)

• Quantified ROI commitments (e.g., 30% time savings, 95% accuracy)

Ongoing Partnership

Post-pilot, we scale successful agents enterprise-wide and introduce new capabilities quarterly. You retain full IP ownership and can insource management when ready; though most clients prefer our continuous optimization model.

CONTACT US

Ready to transform your marine insurance operations with Agentic AI?

Email: Hello@TheAgentics.co

Website: https://TheAgentics.Co

Global Presence: Amsterdam, Zurich, Istanbul, Toronto, Bengaluru, Mumbai, Warsaw, Lisbon, Johannesburg, Singapore, New Delhi, Buenos Aires

WE BUILD. WE SCALE. WE OPTIMIZE.

Transform Your Marine Insurance Business into an AI-Native Enterprise